Transitions and Implementation Work Group – Finance and Corporate Strategies

Cities face challenges for financing urban resilience to extremes. For instance:

- Return on investment for resilience is not clear,

- Planning horizons do not extend beyond next few decades,

- City risk tolerance for debt is low, and

- There is a tension between insufficient revenue and enough reserve to pay for infrastructure projects.

How are cities paying for climate resilience?

According a 2019 review of how eight US cities have been organizing climate-resilience funding, authors (including UREx practitioner affiliates) identified eight general local government strategies being used to finance climate resilience:

- Generate Local Revenue. Produce revenue for government climate-resilience public infrastructure by taxing local property owners and charging utility ratepayers.

- Impose Land-Use Costs. Adopt land-use and building regulations and policies that place undetermined future resilience-building costs on property owners and developers, rather than on government.

- Embed Resilience Standards into Future Infrastructure Investments. Ensure that all future capital spending for public infrastructure will be designed to strengthen climate resilience as much as possible.

- Leverage Development Opportunities. Link resilience-building projects with real estate development opportunities to generate public-private partnerships that invest in both public infrastructure and private development.

- Exploit Federal Funding Niches. Identify resilience-friendly federal funding streams and develop projects that fit pre- and post-disaster program requirements.

- Tap State Government. Mine existing state programs, or seek to modify them, to obtain funds for local climate-resilience efforts.

- Develop Financial Innovations. Explore the use of innovative mechanisms for generating public and private revenue for climate-resilience projects, including district-scale financial structures.

-

Pursue Equity in Resilience. Factor social and economic equity into funding and financing actions by serving economic development, housing, and other needs while investing in climate resilience.

These cities’ strategies not only reflect the leading-edge of urban climate-resilience financing practices, but likely foreshadow what other cities already do. Other high-level takeaways identified in this report include:

- The “edge of innovation” is being developed by cities that are already at serious risk, or will be in the near future.

- Cities are mostly adapting existing systems to the challenge of funding resilience investments.

- The practices enable short-term investments, but do not amount to a reliable “system” with anything near the investment capacity needed over the coming decades.

- Many elements of a ”plug and play” system can be informed by these early efforts

- (“Plug and Play” funding: much urban infrastructure is funded from multiple public sources—a “plug and play” matrix of local, state, and federal programs. Knowing which pots can be used for particular projects and how to access them is an important local government competence)

- There is not yet a robust, sustainable system for urban climate resilience finance, and much about city resilience finance that still needs to be figured out.

Climate resilience principles

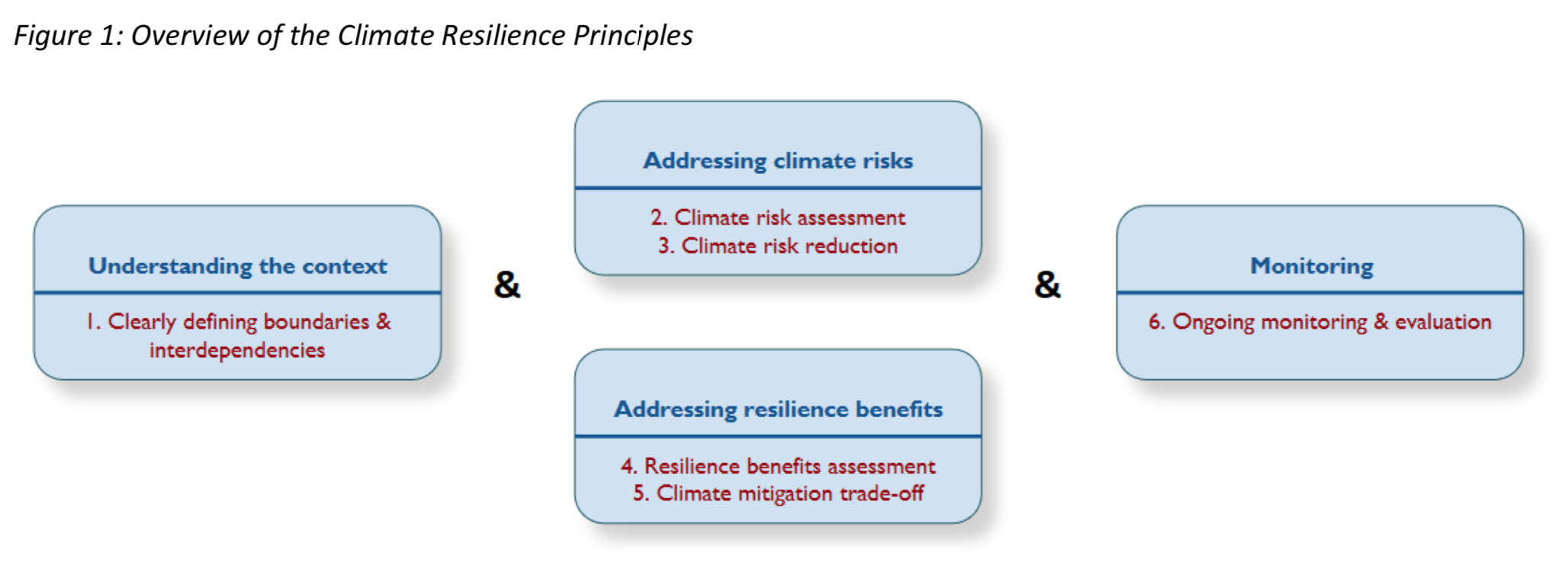

UREx practitioner affiliates also contributed to a 2019 paper by the Climate Bonds Initiative on Climate Resilience Principles. Directed at investors and bond issuers, the paper describes the range of climate resilience investments, methods for assessing climate risk, and ways to credibly demonstrate resilience outcomes. Cities seeking climate resilience finance should follow four principles:

- Understand climate change risks – both hazards and vulnerabilities- faced by assets, activities and systems

- Address these risks through risk-reduction measures that account for climate change uncertainties

- Ensure assets deliver climate resilience benefits over and above addressing identified risks

- Do no harm to communities beyond asset boundaries to avoid perpetuating environmental injustice.

Further Questions

Recent research unveils new questions for the field’s further investigation, such as:

- Governance Structures – Who Does the Work?

- Financing – How Do We Pay for It? Who Pays What Share?

- Regulatory – How Are Plans Legally Codified? How Do We Get It Permitted?

- Infrastructure – How Do We Mandate Resilience Standards for Ongoing Infrastructure Investments?

- How will less affluent cities pay for resilience building?

- As increases in climate hazards drive up demand for urban resilience investment, how will supply grow enough to meet the need?

- How will private investment markets respond to increasing climate disasters, risks, and rising costs for resilience strengthening?

F&C URExSRN Projects:

- Innovation Plazas

- Reports and presentations noted on https://sustainability.asu.edu/urbanresilience/publications/

Related Projects:

- For further examples of city resilience finance mechanisms, see the Smart Cities Financing Guide – Center for Urban Innovation

- Climate Resilience Consulting: reports and presentations

Contacts:

Climate Resilience Consulting

joyce@climateresilienceconsulting.com

Center for Urban Innovation, Arizona State University

dswindell@asu.org